What is a Credit Report?

What is a Credit Report and How is It Different from Your Credit Score?

There are two types of credit reports that Lenders look at.

They look at these reports when you apply for finance.

– A consumer report is often associated with a particular individual.

– A commercial report may be associated with a business.

A credit score is computed based on the information contained in your credit reports.

It serves as an indicator of the trustworthiness of a person’s or organization’s financial history.

It can be used to predict behaviour and show risk for lenders, insurers and other parties who offer services or extend credit to individuals.

Understanding what information is included in your credit report

Understanding your credit report is an essential step in managing your finances and credit.

A credit report will show you the following:

– The type of account (E.G. credit card, mortgage, personal loan)

– Any recent inquiries on the account

– Recent activity on the account

– The date when the information was compiled

How to Read a Credit Report Summary Page

An important part of managing your credit is knowing what information is on your credit report.

The summary page is a one-page snapshot that summarizes your credit history. It includes the following:

– A list of credits you have for borrowing money and how much you owe

– The date opened and closed, as well as the interest rate of each account

– How much you have paid in total, how long it has been since you last made a payment, and the balance of each account

– The date when an account went into collections, the name of the collector, and any recent activity on that account

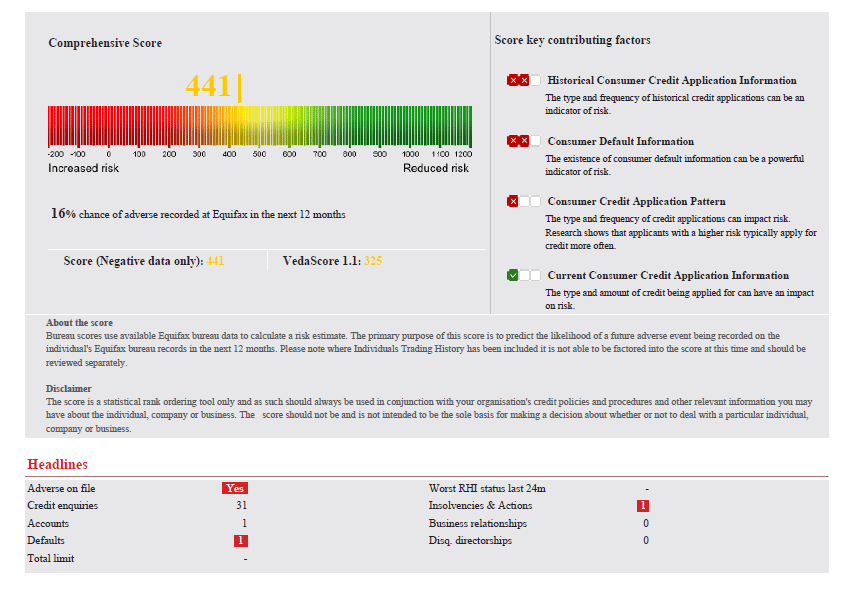

An Example Credit Report Summary is below:

How does your credit score differ from your credit score?

To understand the difference between your credit score and your credit report, you must first know how a credit score is calculated.

A credit score is an indication of your past financial performance.

It informs lenders how risky it may be to grant you a loan or other type of financial service.

The higher the credit rating, the more likely it is that you will be granted this type of service.

For example, if you have an A+ rating then you are much more likely to receive the loan than someone with a low C rating.

Credit reports are compiled by companies like Equifax, Illion and Experian after they analyse data from your monthly payments, public records, and any other information they can find on you.

This document lists all of your debt obligations as well as any other information that can affect your ability to obtain finance.

If you want your credit score to improve, you will need to work on improving your credit report.

Some people may think that they are doomed if their credit score is low because they don’t know how to start.

However, there are a few things that they can do to improve it and making sure the information in the report is accurate.

Here are some tips for making sure you have a good credit score:

– Check for any inaccuracies in your credit report

– Get copies of all of your reports and review them thoroughly

– Take steps to reduce the number of outstanding accounts or debts by paying off as much as possible

If you would like a free assessment of your credit report or help getting your report?

Fill in a contact form here

This article is for information purposes only. It is not considered financial advice.

You can get free financial advice from www.moneysmart.gov.au