Preventing future expensive Credit Repair

During these trying times, it’s very important that you are properly educated when it comes to protecting your credit report from future expensive credit repair!

Credit Reporting has become more complex since the introduction of Comprehensive Credit Reporting in 2014.

Although we didn’t see the changes for a while, we are now seeing most of the changes to our reports.

Changes include:

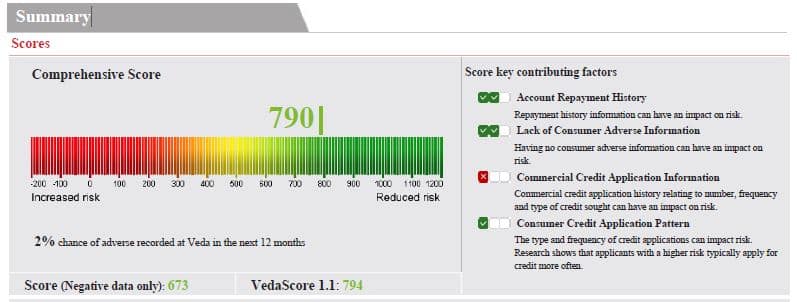

Your Credit Score

We all now have a credit score, ranging from -200 to 1200.

Our scores are based on our historical pattern of applications, current enquiries, our loan repayment history and any negative data, such as defaults and court actions.

Our scores are changing all the time and just one enquiry could pull your score down by 50 to 150 points.

Making sure you stay away from applying online and Payday type loans will help protect your score.

From the image above, you will also see a ‘VedaScore 1.1’.

This is the future score, or where the credit reporting agency believes our scores will sit in the next 12 months.

If this 1.1 score is very low, even if your current score is high, you could get knocked back for finance.

The future score depends on current type of credit sought and your current data, and your credit behavior.

Of course, at the moment, many people are suffering from the current global pandemic and are in need of finance.

Make sure you use a local accredited finance broker to research your Lender options before applying.

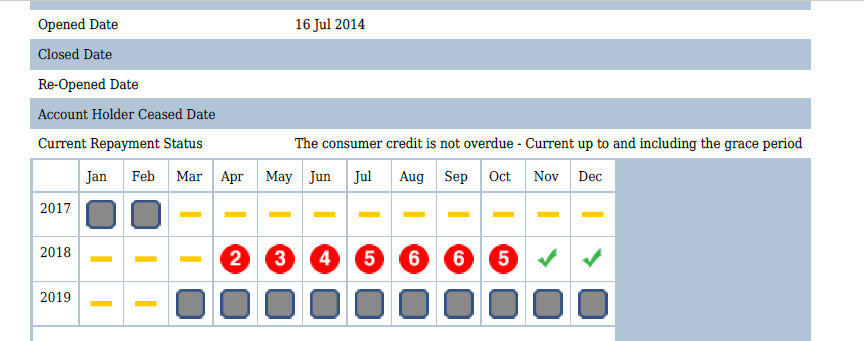

24-month Repayment History Information

In addition to our credit score, many Lenders are also reporting 24 months repayment history information.

You will see that each of your active loans are now recorded on your report.

– Noting if you have paid the loan on time every month.

This information goes back 24 months from today.

A ‘Zero’ is good, indicating zero arrears.

If you miss 1 months, the Lender will record a ‘1’ then a ‘2’ and so on until they finally list a default if you fail to pay for more than 60 days.

It’s crucial that you inform your Lenders if you are experiencing financial hardship.

This prevents them from recording negative repayment history information.

This may not affect you now…

But in a year’s time if you want to apply for a loan, it could stop you from getting the loan approval you need for your family or your business.

Make sure that you are contacting your Lenders in writing or on the phone to arrange financial assistance if you are suffering from financial hardship.

Lenders will then list a “R” for those months on their credit reports, whilst you are in the temporary financial assistance plan.

In the future, an “R” is not going to affect your credit score or ability to obtain finance.

Whereas if you don’t contact your credit providers now and are late on payments, you will have a “1” or “2” or “3” recorded on your repayment history information

This may cause problems in the coming months for you to obtain finance.

Lenders must provide temporary financial hardship, usually in the form of a 3 to 6 month freeze on repayments.

However, when the assistance package finishes, you will have to revert to normal payments.

If you see that there is incorrect repayment history information on your report, you can lodge a complaint to the Lender directly, email is always best, and they will run an investigation into the repayment history information, and amend it, if it is incorrect.

Usually the Lender will get back to you in around 30 to 45 business days.

As per legislation, this is how long Lenders have to reply to any written complaint or request.

Actively protecting our credit reports now will be vital as we struggle through the next few months with many Australians losing their jobs and needing financial assistance.

TOP TIPS

– Make sure you use a finance broker before applying online

– Complete a simple family budget update to make sure that you are covering your debts

– Be proactive and survive the war on corona.

This will greatly help you and your family when it comes to your future financial needs.

Should you have any questions on credit reports, Credit Fix Solutions can be contacted on 1300 43 65 69 or email info@creditfixsolutions.com.au

We offer FREE credit reports, FREE credit report assessments, and No Result No Fee credit repair Australia wide.

NO hidden or upfront fees!